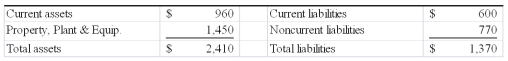

The following information is taken from the balance sheet of Alberta Company:  Alberta Company's current ratio is:

Alberta Company's current ratio is:

Definitions:

Tax Adjustments

Modifications made to financial statements to account for differences between accounting practices and tax regulations.

Bonus Shares

Shares issued to current shareholders at no cost, based on the number of shares that a shareholder owns.

Cash Dividend

A payment of profits by a company to its shareholders, made in cash, as opposed to stock or other forms of payment.

Changes in Equity

Movements in shareholders' equity over a period due to profits, losses, dividends, and transactions with owners in their capacity as owners.

Q14: When is uncollectible accounts expense recognized if

Q44: In preparing the bank reconciliation for Hearst

Q48: What type of account is Accumulated Depreciation?

Q74: For a business, Cash generally includes currency,

Q92: If a company is located in an

Q107: Which of the following accounts appear in

Q127: Give an example of an intangible asset

Q128: On September 1, 2013, Ruiz Company loaned

Q136: All journal entries made related to bank

Q142: The net realizable value of accounts receivable