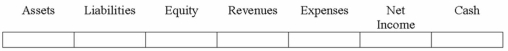

An asset purchased for $12,000 with a $3,000 salvage and a 5 year life is depreciated using straight line depreciation for two years. At the beginning of the third year the useful life of the asset is revised to 4 years. Show how the revision of depreciation expense in the third year of the asset's life will affect the financial statements (compared to the financial statements if the revision in estimate had not been made).

Definitions:

Selling Expenses

Costs directly associated with the marketing and selling of products or services.

Bank Reconciliation

The process of comparing and adjusting the balance shown in an organization's bank statement, with the balance shown in its own financial records.

Deposits In Transit

Funds that have been deposited in a bank account but not yet recorded by the bank in the account balance, often due to timing differences.

NSF Check

A check that cannot be processed due to insufficient funds in the account it's drawn against, leading to a "non-sufficient funds" status.

Q3: Which of the following is not a

Q26: One of the methods of accounting for

Q32: Before a business check is signed, the

Q49: Assuming Chandler uses a LIFO cost flow

Q67: In the reconciliation of the June bank

Q69: In an inflationary period, which cost flow

Q84: Sandridge Company issued five-year 8% bonds with

Q118: Lewiston Company is preparing its financial statements.

Q134: In preparing the bank reconciliation for Hearst

Q138: Which of the following answers correctly states