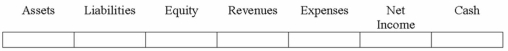

An asset purchased for $12,000 with a $3,000 salvage and a 5 year life is depreciated using straight line depreciation for two years. At the beginning of the third year the useful life of the asset is revised to 4 years. Show how the revision of depreciation expense in the third year of the asset's life will affect the financial statements (compared to the financial statements if the revision in estimate had not been made).

Definitions:

Break-Even

The point where total expenses match total income, leading to neither a profit nor a loss.

Unit Variable Cost

The cost associated with producing one additional unit of product, including materials, labor, and other variable costs.

Fixed Costs

Overheads like rent, salaries, and insurance that stay the same, irrespective of how much is produced or sold.

Break-Even

The point at which total costs equal total revenues, resulting in no net loss or gain for a business.

Q5: Which of the following shows the effect

Q22: Which of the following statements is a

Q36: Indicate whether each of the following statements

Q63: Which of the following businesses would most

Q81: Does US tax law encourage debt financing

Q86: Seattle Co. paid a $200,000 cash dividend

Q108: Indicate whether each of the following statements

Q114: In an inflationary period, which cost flow

Q128: How will a certified check be treated

Q138: Explain the differences in recording the initial