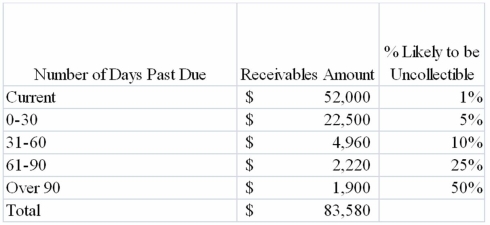

Valdez Company uses the percent of receivables method to estimate uncollectible accounts expense. Valdez began 2013 with balances in Accounts Receivable and Allowance for Doubtful Accounts of $38,250 and $2,900, respectively. During the year, the company wrote off $2,320 in uncollectible accounts. In preparation for the company's 2013 estimate, Valdez prepared the following aging schedule:  What will Valdez record as Uncollectible Accounts Expense for 2013?

What will Valdez record as Uncollectible Accounts Expense for 2013?

Definitions:

GICs

Guaranteed Investment Certificates are a form of investment in Canada that ensures a fixed rate of return for a specific duration.

Simple Interest

Interest calculated on the principal amount of a loan or deposit, not including any previously earned interest.

Financial Position

Represents the net worth of an entity, detailing assets, liabilities, and shareholders' equity at a specific point in time.

Assignable Loan Contract

A loan agreement that allows the lender to transfer or assign the loan to another party.

Q36: How is the number of days to

Q37: Which of the following describes the characteristics

Q39: Park Enterprises issued bonds with a face

Q39: The net cash flow from operating activities

Q49: If a company uses the effective interest

Q57: Vance Company accepted a 12-month, 7% promissory

Q83: Jackson Company is preparing to repay a

Q95: The current ratio is computed as follows:<br>A)Current

Q116: Indicate whether each of the following statements

Q137: Which of the following retailers would be