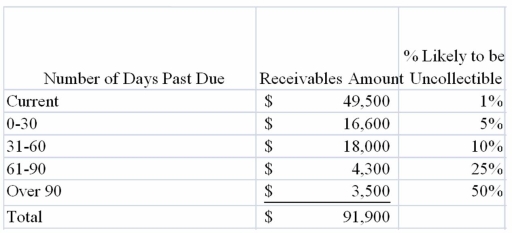

Chancellor Company began 2013 with balances in accounts receivable and allowance for doubtful accounts of $88,600 and $3,350, respectively. The company reported credit sales of $980,500 during the year, and wrote off $2,800 of uncollectible accounts. Chancellor Company prepared the following aging schedule on December 31, 2013:  Required:

Required:

a) Prepare general journal entries to record the 2013 credit sales, collection of accounts receivable, write-off of uncollectible accounts, and estimate of uncollectible accounts.

b) What is Chancellor Company's net realizable value of receivables after all of the above entries have been made?

Definitions:

Absorption Costing

An accounting method that includes all manufacturing costs — direct materials, direct labor, and both variable and fixed manufacturing overhead — in the cost of a product.

Operating Income

A measure of a company's profit that excludes non-operating expenses and revenues, focusing solely on the income generated from its core business operations.

Inventory Levels

The quantity of goods and materials on hand at a particular time within a company.

Variable Costing Income Statement

A financial statement showing the costs that vary directly with the level of production, separated from fixed costs.

Q17: Which of the following answers correctly states

Q30: In preparing the April bank reconciliation for

Q40: The following transactions apply to Baker Corporation.<br>1)

Q55: Depletion of a natural resource is usually

Q56: Employers must withhold unemployment taxes from employee

Q72: A trial balance can only be prepared

Q117: How do the issuance of a note

Q136: On January 1, 2013, Crown Co. issued

Q138: Company A and Company B are similar

Q139: The following information is available for Pho