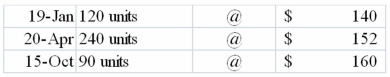

Mandela Company's first year in operation was 2013. The following inventory information comes from Mandela's accounting records for the year.  During the year, Mandela sold 350 units for $240 each. Operating expenses for the year were $15,000, and the tax rate was 30%.

During the year, Mandela sold 350 units for $240 each. Operating expenses for the year were $15,000, and the tax rate was 30%.

Required:

a) Calculate the cost of goods sold by LIFO and by FIFO.

b) What amount of income tax would Mandela have to pay if it uses LIFO? If it uses FIFO?

c) Assuming that the results for 2013 are representative of what Mandela can generally expect, would you recommend that the company use LIFO or FIFO? Explain.

Definitions:

Absenteeism

Absenteeism is the frequent absence from work or other obligations without valid reasons, affecting productivity and efficiency.

Gain-Sharing Plans

Incentive plans that reward employees for contributing to a company's increased productivity or profitability.

Current Distribution

The process or manner by which resources, earnings, or assets are apportioned at the present time.

Cash Plan

A type of health insurance plan that covers everyday medical expenses and provides cash payments for specified conditions or treatment.

Q14: If Beamon Company is using FIFO, how

Q24: Which of the following is decreased with

Q29: The most favorable audit opinion that a

Q58: What accounting steps would a firm normally

Q85: Describe the transaction shown in the following

Q105: Which of the following measurements would not

Q110: Which of the following would not be

Q135: Kenyon Company uses accrual accounting. Indicate whether

Q143: A debit entry<br>A)increases assets.<br>B)increases expenses.<br>C)decreases liabilities.<br>D)all of

Q148: In the closing process, the amounts in