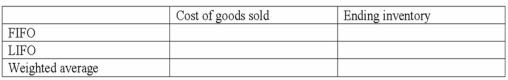

Jenkins Company sells home weather exercise bikes. Its beginning inventory was 50 units at $200 per unit. During the year, Jenkins made two purchases of the bikes: first, a 150-unit purchase at $220 per unit, and then 100 units at $250 per unit. The ending inventory for the year was 125 units.

Required:

Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Jenkins uses

a) FIFO

b) LIFO

c) Weighted average

Definitions:

Copyright

A legal right granted to the creator of original works of authorship, such as literary, dramatic, musical, artistic works, and certain other intellectual property, to publish, use, and sell their creation for a specified period of time.

Patent

A government grant giving an inventor exclusive rights to make, use, or sell an invention for a specified period in exchange for public disclosure of the invention.

Trademark

A legal designation of exclusive use of a brand or product name.

Goodwill

An intangible asset that represents the portion of the business value that cannot be attributed to other business assets.

Q1: A bank statement debit memo describes a

Q10: On June 1, 2013, merchandise subject to

Q30: In preparing the April bank reconciliation for

Q41: The best estimate for the amount of

Q86: A company's amount of cost of goods

Q91: On August 1, 2013, Barnabas Company issued

Q94: Discuss the importance of ethics in the

Q98: What is the purpose of establishing a

Q110: Which of the following would not be

Q150: Jack Grimes started a consulting business, Grimes