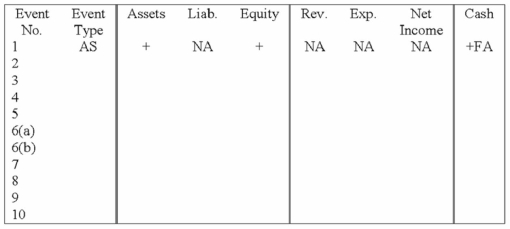

Ragged Mountain Running Shop, which uses the perpetual inventory system, experienced the following events during December 2013:

1. Issued common stock for cash.

2. Borrowed money from the Star City Bank issuing a note payable.

3. Purchased inventory on account, terms 2/10, n/30, FOB shipping point.

4. Returned part of the merchandise purchased in event #3.

5. Paid shipping costs on merchandise purchased in event #3.

6. Sold merchandise for cash. Label the revenue recognition 6(a) and the expense recognition 6(b).

7. Paid shipping costs for goods sold in event #6.

8. Recorded the discount allowed in event #3.

9. Recorded the payment for goods purchased in event #3.

10. Accrued interest on the note payable issued in event #2 (note is not due for several months).

Required:

Identify each event as asset source (AS), asset use (AU), asset exchange (AE), or claims exchange (CE). Also explain how each event affects the financial statements by placing a + for increase, - for decrease, NA for not affected under each of the components of the following statements model. Also, indicate in the cash column if the event would be recorded as an operating activity (OA), an investing activity (IA) or a financing activity (FA). The first event is recorded as an example.

Definitions:

Output

The amount of goods or services produced by a company, country, or economic system.

Human Development Index

An index measuring average achievements in a country in three basic dimensions of human development: long and healthy life, knowledge, and a decent standard of living.

Purchasing Power Parity

An economic theory and a method to compare the relative value of currencies, based on the cost of a standard set of goods and services in different countries.

Per Capita Income

The average income earned per person in a given area in a specified year.

Q8: The purpose of the accrual basis of

Q69: Which of the following is an asset

Q71: A monopoly firm will sell _output and

Q80: The following events apply to Bowen's Cleaning

Q97: Recognition of depreciation expense on equipment decreases

Q100: An asset source transaction increases a business's

Q102: Inventory turnover is calculated by dividing:<br>A)cost of

Q124: Which is one effect of the following

Q140: Creighton Company accrued $120 of interest expense.

Q146: An adjusting entry recorded as a debit