Below are listed several transactions that a business may enter into.

1. Provide services to customers on account

2. Purchase land by paying cash

3. Purchase a fire insurance policy that will provide coverage for a two-year period

4. Acquire cash by issuing common stock

5. Recognize expense for amount of office supplies that had been used during the period

6. Receive payment from a customer for services that will be provided over the next six months

Required:

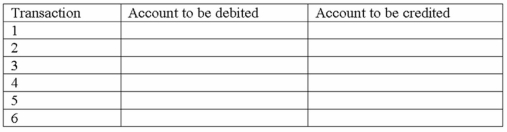

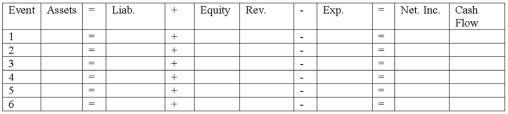

a) In the table below, indicate the accounts that would be debited and credited for each of the preceding transactions.  b) Show how each transaction affects the financial statements by placing a + for increase, - for decrease, and NA for not affected under each component in the horizontal financial statements model shown below. In the Cash Flow column, use the letters OA for operating activities, IA for investing activities, and FA for financing activities.

b) Show how each transaction affects the financial statements by placing a + for increase, - for decrease, and NA for not affected under each component in the horizontal financial statements model shown below. In the Cash Flow column, use the letters OA for operating activities, IA for investing activities, and FA for financing activities.

Definitions:

PV Function

In financial analysis, a function used to calculate the Present Value of a series of future payments or receivables, discounted at a given interest rate.

Investment

The allocation of resources, usually money, in the expectation of generating an income or profit.

Defined Name

A feature in spreadsheet software that allows users to assign a meaningful name to a cell, range of cells, formula, or constant value.

Scope

The extent to which variables, functions, and declarations are visible or able to be used within a portion of a program.

Q2: After the temporary accounts are closed, what

Q8: The purpose of the accrual basis of

Q18: Indicate whether each of the following statements

Q61: Mountain Stream Outfitters is a merchandiser of

Q86: Sinclair, Inc. uses the perpetual inventory system.

Q94: Discuss the importance of ethics in the

Q112: Greene's cost of goods sold under FIFO

Q133: Merchandising businesses include retail companies and wholesale

Q133: Under the VER of the 1980s, U.S.

Q139: Greene's ending inventory under LIFO would be:<br>A)$910.<br>B)$820.<br>C)$740.<br>D)$650.