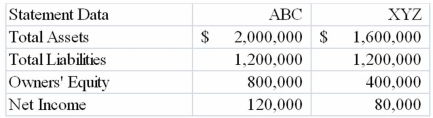

At the end of 2013, the following information is available for ABC Company and XYZ Company:  Required:

Required:

1) For each company, calculate the debt to assets ratio and the return on equity ratio.

2) For each company, calculate the return on assets ratio.

3) Which company had a greater level of debt risk? Why?

4) What is financial leverage? Which company is using financial leverage more successfully?

Definitions:

Short-Run Instability

A situation in economics where variables such as output, employment, and prices are subject to frequent fluctuations over a short period.

Agriculture

The activity of farming the land, cultivating plants, and breeding animals for human needs and sustenance.

Causes

The reasons or motives behind certain events, actions, or outcomes, identifying why something happens.

Bumper Crop

An unusually large harvest of crops in a particular year.

Q13: Bridgewater Company paid $450 in interest on

Q19: Which of the following would cause net

Q49: The amount of retained earnings appearing on

Q59: With free trade, the demand curve facing

Q66: Under a periodic system, the account debited

Q74: Indicate whether each of the following statements

Q98: What is Yi's net cash flow from

Q119: Which resource provider typically receives first priority

Q137: Countervailing duties are:<br>A) applied to dumped imports.<br>B)

Q167: Which of the following examples cited in