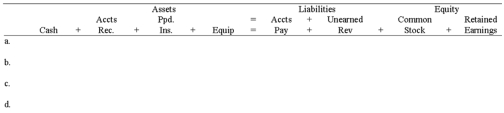

Using the form below, record each of the following 2013 transactions for Morris Corporation:

a) Nov. 1. Received cash from clients for services to be performed over the next six months, $6,000.

b) Nov. 1. Paid $600 for a 12-month insurance policy.

c) Dec. 31. Recorded expiration of two months of the insurance.

d) Dec. 31. Earned $2,000 of the amount received from clients in November.

Definitions:

Co-Ownership

The condition or act of owning something together with one or more parties.

Capital Contributions

Investments made by owners or partners in a business, typically in the form of cash, property, or other assets, to provide funding for the business.

Management

The process of dealing with or controlling things or people within an organization.

Profit

The financial gain that is made when the revenue from business activities exceeds its costs.

Q23: What does a company's statement of cash

Q23: The term "FOB shipping point" indicates that

Q37: An internationally discriminating monopolist is one that:<br>A)

Q43: On February 2, 2013, a fire destroyed

Q71: Treadwell Company borrowed $32,000 of cash from

Q79: Why are antidumping actions used more frequently

Q80: Frank Co. purchased $15,000 of merchandise inventory

Q86: Ashley Dodd had the following transactions for

Q112: Consider an economy with a fixed exchange

Q140: Creighton Company accrued $120 of interest expense.