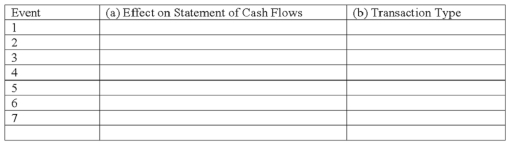

The following transactions apply to Kent Company.

1) Issued common stock for $21,000 cash

2) Provided services to customers for $28,000 on account

3) Purchased land for $18,000 cash

4) Incurred $9,000 of operating expenses on account

5) Collected $15,000 cash from customers for services provided in event #2

6) Paid $7,000 on accounts payable

7) Paid $2,500 dividends to stockholders

Required:

a) Identify the effect on the Statement of Cash Flows, if any, for each of the above transactions. Indicate whether each transaction involves operating, investing, or financing activities and the amount of increase or decrease.

b) Classify the above accounting events into one of four types of transactions (asset source, asset use, asset exchange, claims exchange).

Definitions:

Sole Proprietorship

A business structure owned by a single individual, where there's no legal distinction between the owner and the business.

Liable

Legally responsible or obligated to face consequences, typically in the form of compensations or reparations.

Profits

Financial gains obtained after subtracting the costs, expenses, and taxes from a business's total revenue.

Employment Law

A branch of law that governs the rights and duties between employers and workers, covering areas such as wages, workplace safety, discrimination, and termination.

Q23: The term "FOB shipping point" indicates that

Q26: Which of the following transactions does not

Q40: Purchasing prepaid rent is classified as a(n):<br>A)asset

Q58: What accounting steps would a firm normally

Q60: From what three sources does a business

Q66: Newcomb Company began operations on December 1,

Q94: (Scenario: A Monopolist) A monopolist faces a

Q129: Which of the following items would appear

Q140: An adjusting entry recorded as a debit

Q144: An example in the text of Argentina's