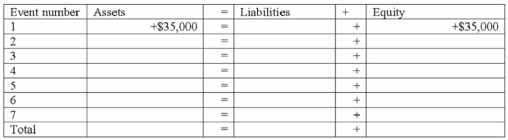

The following events occurred for Jarvis Company during 2012, its first year in operation:

1. issued stock to investors for $35,000 cash

2. borrowed $15,000 cash from the local bank

3. provided services to its customers and received $22,000 cash

4. paid expenses of $18,000

5. paid $12,000 cash for land

6. paid dividend of $2,000 to stockholders

7. repaid $2,000 of the loan listed in item 2

Required:

Show the effects of the above transactions on the accounting equation, below. Include dollar amounts of increases and decreases. The first is done for you. After entering all the events, calculate the total amounts of assets, liabilities, and equity at the end of the year.

Definitions:

Risk Premium

The extra return expected by investors for holding a riskier investment over a risk-free asset.

Diversifiable Risk

Is the type of investment risk that can be reduced through diversification of a portfolio, related to specific factors affecting individual companies or sectors.

Market Rewards

The returns or gains that investors expect to earn from their investments in the financial markets.

Non-diversifiable Risks

Risks that affect all investments across the market and cannot be mitigated through diversification.

Q4: The amount of assets on Petras's 2013

Q13: Vegas Co. issued a note to purchase

Q18: In comparison to the welfare effects of

Q18: Which company has the highest level of

Q42: Why might imperfect competition lead to small

Q50: Which of the following statements is true?<br>A)Balance

Q51: Indicate whether each of the following statements

Q77: Suppose that the free-trade price of a

Q78: The Warner Company issued common stock for

Q119: An increase to a liability account is