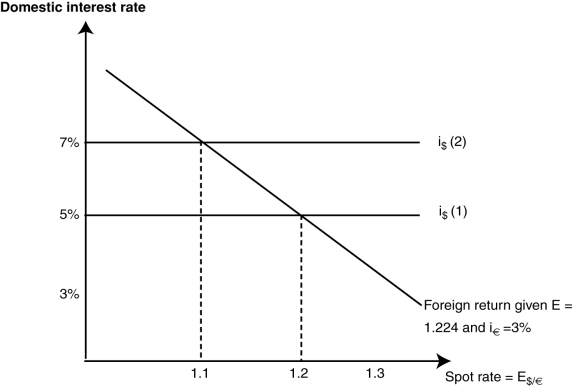

(Figure: The Domestic Interest Rate) Using the graph, if the dollar rate of interest increases from 5% to 7%, what result will occur in the short run?

Definitions:

Fixed-Income Market

The segment of the financial markets where instruments that pay a set return over a period are traded, such as bonds and treasuries.

Asset-Backed Debt

Debt securities or obligations that are secured by a pool of underlying assets, such as loans, leases, or receivables.

Corporate Debt

Corporate debt refers to the amount of money that a company borrows from various sources, including bank loans and issuing bonds, to finance its operations and growth.

Commercial Paper

Short-term, unsecured debt issued by companies to finance immediate liquidity needs.

Q16: Your text authors state that in the

Q24: When FDI occurs, what are the long-run

Q25: In the short run, when the central

Q26: When the exchange rate depreciates in the

Q30: A "specific" factor of production is:<br>A) critical

Q43: In the international goods market, prices of

Q71: (Table: Home and Foreign Prices for Manufacturing

Q109: Suppose domestic interest rates are at 4.55%,

Q127: If we measure scarcity or abundance correctly,

Q160: If Europe has a real GDP growth