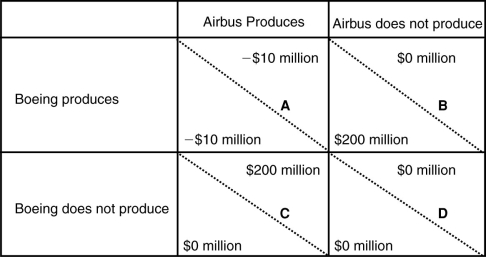

(Scenario: Payoff Matrix for Airbus and Boeing) This payoff matrix describes actions in developing so-called superjumbo jets that can carry 600 or more passengers. In each element, the lower-left value gives the outcome for Boeing based on the action of Airbus and the upper-right value gives the outcome for Airbus based on the action of Boeing. For example, in element A, each company will lose $10 million if they both decide to produce superjumbo jets.  Which element in the payoff matrix describes the best choices of Airbus and Boeing when Boeing receives a $50 million subsidy?

Which element in the payoff matrix describes the best choices of Airbus and Boeing when Boeing receives a $50 million subsidy?

Definitions:

M3

A broad measure of a country's money supply that includes M2 plus large time deposits, institutional money market funds, and short-term repurchase agreements.

Small Denomination

refers to currency or financial instruments that have a low face value.

Large Denomination

Refers to currency notes or financial instruments issued in high value amounts, simplifying large transactions or investments.

M2

A metric assessing the volume of monetary assets available, comprising both physical cash, deposits in checking accounts, and liquid assets like savings deposits and money market investments.

Q21: Which of the following statements about the

Q22: Some studies find that trade in the

Q26: The TPP:<br>A) has no provisions regarding labor

Q35: What is the difference between an open

Q45: The advantages of a currency union may

Q80: The Big Mac index illustrates that in

Q84: Which of the following will increase trade

Q100: Why did China recently change its export

Q126: Which of the following countries is part

Q152: In 2014, the European Union filed a