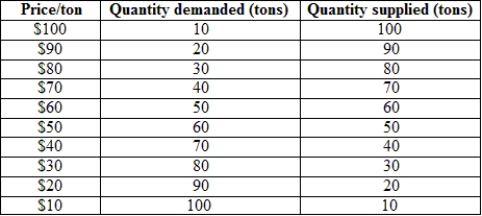

(Scenario: Demand and Supply for Iron Ore) This table represents a demand and supply schedule for a small-country producer of iron ore. It sells output in its home market and on the world market at the world price of $70 per ton. Table: Demand and Supply for Iron Ore  What is the total value of the export subsidy that exporters receive?

What is the total value of the export subsidy that exporters receive?

Definitions:

Risk-Free Rate

The theoretical rate of return of an investment with zero risk, typically represented by government bonds.

Market Risk Premium

The additional profit that an investor predicts they will earn from a risky market portfolio as opposed to risk-free financial instruments.

Expected Return

The anticipated average return on an investment, taking into account all potential outcomes and their probabilities.

Probability

The measure of the likelihood that an event will occur, quantified as a number between 0 and 1, where 0 indicates impossibility and 1 indicates certainty.

Q27: Compared with 100 years ago, the number

Q49: How does labor mobility play into an

Q54: Contributing to the crisis may have been

Q68: A regional trade agreement involves:<br>A) most, if

Q72: Compared with the U.S. dollar-euro, the U.S.

Q127: (Scenario: Payoff Matrix) The payoff matrix shows

Q144: Which of the following is the most

Q148: Who gains from an export tariff in

Q158: In which form of regional trading agreements

Q173: (Figure: The Home and World Markets) The