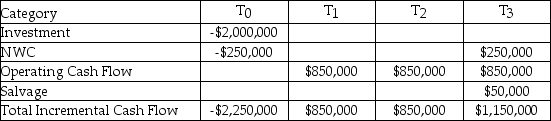

Your firm has an average-risk project under consideration.You choose to fund the project in the same manner as the firm's existing capital structure.If the cost of debt is 9.00%,the cost of preferred stock is 12.00%,the cost of common stock is 16.00%,and the WACC adjusted for taxes is 14.00%,what is the NPV of the project,given the expected cash flows listed here?

Definitions:

Cross Selling

The practice of selling additional products or services to an existing customer, often to increase revenue without the cost of acquiring a new customer.

Product Development Method

An approach or set of structured steps used to guide the development of a new product from concept to market launch.

Existing Customers

Individuals or entities that have previously purchased or currently use a company's products or services.

Growth Strategies

Plans implemented by organizations to increase their size, revenue, or market share through diversification, market penetration, product development, or market development.

Q5: Southwest Co.purchases an asset for $60,000.This asset

Q6: Use the dividend growth model to determine

Q16: Over the 50-year period from 1950 to

Q45: Explain why one must be careful when

Q54: The practice of not putting all of

Q55: The textbook labels preferred stock as "hybrid

Q65: When a depreciable asset is sold,a tax

Q78: When estimating the impact of a capital

Q79: Acme,Inc.is considering a four-year project that has

Q88: Elway Electronics has debt with a market