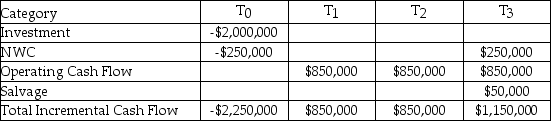

Your firm has an average-risk project under consideration.You choose to fund the project in the same manner as the firm's existing capital structure.If the cost of debt is 9.00%,the cost of preferred stock is 12.00%,the cost of common stock is 16.00%,and the WACC adjusted for taxes is 14.00%,what is the IRR of the project given the expected cash flows listed here? Use a financial calculator to determine your answer.

Definitions:

Dollar-Denominated Assets

Financial assets that are valued in U.S. dollars, regardless of where they are located or who owns them.

Real Value

The value of an asset, product, or service, adjusted for inflation, reflecting its purchasing power and true cost over time.

Dollar-Denominated Assets

Financial assets such as stocks, bonds, or real estate investments that are valued in U.S. dollars.

Real Value

Real value refers to the worth of a good or service taking into account inflation, providing a more accurate measure over time.

Q1: One examines concepts such as sunk costs,opportunity

Q8: The Cougar Corporation has issued 20-year semiannual

Q24: Briefly explain the difference between a USE

Q38: The coupon rate for a bond is

Q39: Houston Investments (HI),an investment banking firm,has proposed

Q45: Which of the statements below is TRUE

Q54: The original Modigliani and Miller proposition I

Q69: The Internal Rate of Return (IRR)Model suffers

Q77: Shortcomings of the dividend pricing models suggest

Q82: Pacific Automotive has a $250,000 compensating balance