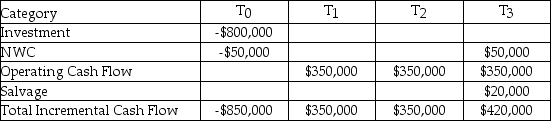

Your firm has an average-risk project under consideration.You choose to fund the project in the same manner as the firm's existing capital structure.If the cost of debt is 9.50%,the cost of preferred stock is 10.00%,the cost of common stock is 12.00%,and the WACC adjusted for taxes is 11.50%,what is the IRR of the project,given the expected cash flows listed here? Use a financial calculator to determine your answer.

Definitions:

Rubella

A contagious viral infection best known for its distinctive red rash, also called German measles, which is particularly dangerous for pregnant women.

First Trimester

The initial stage of pregnancy, encompassing the first twelve weeks, critical for the development of the embryo into a fetus.

Plasticity

The brain's ability to modify and adjust its structure and functions based on new experiences, education, or after sustaining damage.

Resilience

The ability to withstand or recover quickly from difficult conditions or to successfully adapt to adversity.

Q3: A firm is considering four projects with

Q3: Your bank has agreed to grant you

Q3: Which of the statements below is NOT

Q27: Of the following items,which would be considered

Q44: Which of the below does a pro

Q62: Project A has an NPV of $20,000

Q65: In regard to the NPV method,which of

Q76: Your firm has just issued a 20-year

Q90: Apple,Inc.is considering Project A and Project B,which

Q96: The more positive the degree of correlation