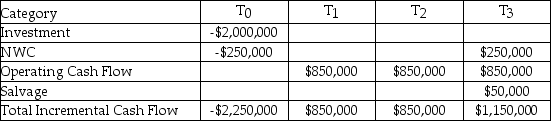

Your firm has an average-risk project under consideration.You choose to fund the project in the same manner as the firm's existing capital structure.If the cost of debt is 9.00%,the cost of preferred stock is 12.00%,the cost of common stock is 16.00%,and the WACC adjusted for taxes is 14.00%,what is the IRR of the project given the expected cash flows listed here? Use a financial calculator to determine your answer.

Definitions:

Polypeptide

A chain of amino acids linked by peptide bonds, which can form part of a protein or act as a functional unit on its own.

Protein

Large biomolecules consisting of one or more long chains of amino acid residues, essential for the body's structure and regulation.

Dipeptide

A molecule consisting of two amino acids linked together by a single peptide bond.

Emulsification

The process of breaking down large fat droplets into smaller ones, typically using bile acids, which increases the digestive enzymes' access to the fats.

Q3: Dividend models suggest that the value of

Q11: Jasper Inc.has credit terms of 2/10 net

Q13: _ refers to how quickly information is

Q18: Mountain Treks Inc.has issued ten-year zero-coupon bonds

Q50: Operating Cash Flow (OCF)= EBIT + Depreciation

Q52: When calculating the after-tax weighted average cost

Q55: _ costs each year do not reflect

Q78: Assuming that stocks represent most industries,the number

Q80: Forecasting entails drawing a financial picture of

Q102: Bestor Bookkeeping has a $150,000 compensating balance