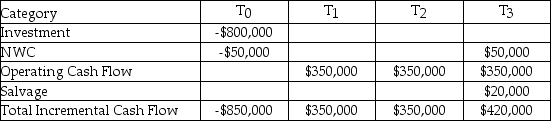

Your firm has an average-risk project under consideration.You choose to fund the project in the same manner as the firm's existing capital structure.If the cost of debt is 9.50%,the cost of preferred stock is 10.00%,the cost of common stock is 12.00%,and the WACC adjusted for taxes is 11.50%,what is the IRR of the project,given the expected cash flows listed here? Use a financial calculator to determine your answer.

Definitions:

Investment Account

An account held at a financial institution for the purpose of managing securities, such as stocks and bonds, for investment purposes.

Equity Method

An accounting technique used to record investments in other companies, where the investment is initially recorded at cost and adjusted over time for the investor's share of the investee's net profits or losses.

Undervalued Inventory

Inventory items that are reported at a value lower than their actual market value or cost of replacement.

Non-Controlling Interest

A minority shareholding in a company, representing an ownership stake that is less than 50% and does not allow for control over the company's operations.

Q1: Travel and Tow Trailers Inc.makes small

Q14: Briefly describe the costs included in the

Q18: The _ is the formal contract for

Q23: Capital budgeting decisions are typically long-term decisions.

Q24: Briefly explain the difference between a USE

Q36: Fifteen years ago TravelEasy Inc.issued twenty-five-year 10%

Q43: Ringtones Inc.wishes to issue new bonds but

Q47: Finding the equivalent annual annuity (EAA)is a

Q64: In using the ABC type inventory classification

Q73: One definition of return is: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1799/.jpg"