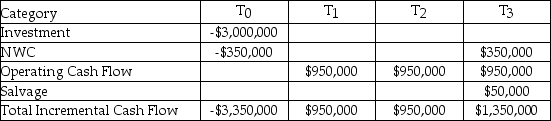

Your firm has an average-risk project under consideration.You choose to fund the project in the same manner as the firm's existing capital structure.If the cost of debt is 11.00%,the cost of preferred stock is 12.00%,the cost of common stock is 17.00%,and the WACC adjusted for taxes is 15.00%,what is the NPV of the project,given the expected cash flows listed here?

Definitions:

Standardization

Defining uniform testing procedures and meaningful scores by comparison with the performance of a pretested group.

Independent Intelligences

A theory suggesting that intelligence is not a single ability but comprises multiple independent abilities.

Specific Mental Abilities

Distinct skills or capabilities involving cognitive functions, such as memory, reasoning, or problem-solving, that vary from person to person.

Cultural Context

The set of social, historical, and cultural circumstances surrounding an event, story, or development, influencing its interpretation or perception.

Q5: Southwest Co.purchases an asset for $60,000.This asset

Q15: Explain the distinction between profits and cash

Q47: Houston Investments (HI),a Texas-based investment banking firm,has

Q48: Based on the sales forecast,the finance manager

Q61: The accelerated write-off of capital costs in

Q68: If an asset's disposal value is greater

Q74: A line of credit is a secured

Q80: Zero-coupon U.S.Government bonds are known as _.<br>A)STRIPS<br>B)muni-bonds<br>C)Uncle

Q88: Elway Electronics has debt with a market

Q90: The _ are quite dynamic in terms