Essay

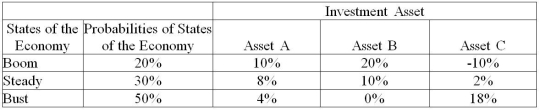

Use the information in the table to calculate the expected return and standard deviation of an equally-weighted portfolio.

Definitions:

Related Questions

Q6: The correlation coefficient,a measurement of the co-movement

Q12: Johnson has an annuity due that pays

Q29: Ready Tees,an online retailer of t-shirts,orders 100,000

Q41: Blackburn Inc.has issued 30-year $1,000 face value,10%

Q43: Weston Inc.just agreed to pay $8,000 today,$10,000

Q54: You have $50,000 invested in an account

Q65: If we want to get some idea

Q82: Given a positive interest rate and a

Q104: The last interest payment on a 12-year,6%,$138,000,fully-amortized

Q114: For most stocks,the correlation coefficient with other