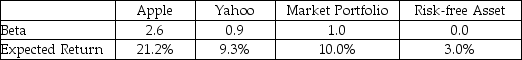

Assume that both Apple and Yahoo plot on the SML.Apple has a beta of 2.6 and an expected return of 21.2%.Yahoo has a beta of 0.90 and an expected return of 9.3%.The expected return on the market portfolio is 10%and the risk-free rate is 3%.If you wish to hold a portfolio consisting of Apple and Yahoo and have a portfolio beta equal to 1.5,what proportion of the portfolio must be in Apple? What is the expected return on the portfolio?

Definitions:

Sequential Function Chart

A graphical programming language used in PLC programming, representing the sequence of operations or steps in a process.

Instruction Y

A placeholder for a specific, yet undefined, instruction within a programming or control system context.

Examine If Closed

A control logic command used to check if a switch or contact is in the closed (conducting) state in programming languages.

Q2: A two-year investment of $200 is made

Q5: Differences in borrowing rates can generally be

Q14: You buy a stock for which you

Q23: In the United States,there are three well

Q65: If we want to get some idea

Q83: For estimating NPV,the IRR is the appropriate

Q85: TVM formulas provide answers for periodic rates

Q87: Describe the three types of financial instruments

Q87: Stocks A,B,C,and D have returns of 10%,20%,30%,and

Q100: When a company has excess funds,it has