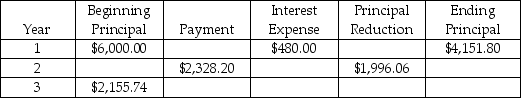

Complete the equal-payments three-year amortization table.

Definitions:

Subtraction

A basic mathematical operation representing the difference between numbers or quantities.

Straight-Line Depreciation

Straight-line depreciation is a method of allocating the cost of a tangible asset over its useful life in equal installments.

Depreciation

Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life, reflecting the reduction in value over time.

Useful Life

The estimated period over which an asset is expected to be usable by the entity owning it, affecting depreciation calculations.

Q13: Explain the difference in the two main

Q32: If you borrow $100,000 at an annual

Q37: As applied to mortgage loans,which of the

Q74: Which of the statements below is FALSE?<br>A)Common

Q78: Harold's parents have offered him a $10,000

Q92: The default risk premium for U.S.corporate bonds

Q99: Managing the firm's short-term financing activities is

Q103: The real rate is 2.50% and inflation

Q106: A two-year investment of $3500 is made

Q108: What is the present value of a