Use the following to answer questions :

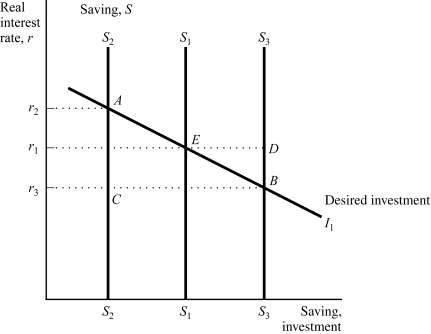

Exhibit: Saving, Investment, and the Interest Rate 1

-(Exhibit: Saving, Investment, and the Interest Rate 1) The economy begins in equilibrium at Point E, representing the real interest rate, r1, at which saving, S1, equals desired investment, I1. What will be the new equilibrium combination of real interest rate, saving, and investment if the government increases spending, holding other factors constant?

Definitions:

Financial Report

A Financial Report is a comprehensive statement detailing financial performance, position, and cash flows of a business over a specific period, facilitating decision-making.

Percent Of Increase

A financial metric that calculates the percentage change in a fiscal variable or amount over a specific period of time, indicating growth.

Common-Size Balance Sheet

A balance sheet where each line item is expressed as a percentage of total assets, facilitating comparison across periods or companies.

Balance Sheet

A financial statement that reflects the financial position of a company at a specific point in time, detailing assets, liabilities, and owners' equity.

Q7: Banks create money in:<br>A) a 100-percent-reserve banking

Q14: The investment function slopes _ because there

Q24: The ratio of the money supply to

Q43: The time between a shock to the

Q46: A well-functioning financial system does all of

Q55: Public saving is:<br>A) always positive.<br>B) always negative.<br>C)

Q62: The demand for the economy's output:<br>A) is

Q110: Imputed values included in GDP are the:<br>A)

Q117: An example of a real variable is

Q120: Economic statistics are not perfect. Explain at