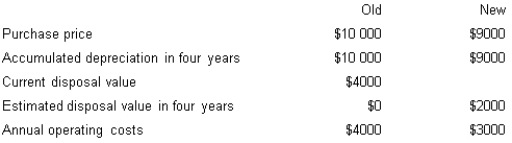

Cubbies Pty Ltd is considering the purchase of a new machine to replace an old machine. Selected cost data pertaining to the two machines is provided below.

At the end of four years, the company plans to discontinue the product line for which the machines are used. Income taxes can be ignored. Using the incremental cost approach, calculate the current period (i.e. year zero) cash flows relevant to acquiring the new machine.

Definitions:

Wash Sale Rules

IRS regulations that disallow the claim of a capital loss for tax purposes if a substantially identical security is purchased within 30 days before or after the sale.

Loss Disallowed

A financial loss that cannot be deducted from taxable income as per tax regulations, often due to specific restrictions or limitations.

Personal Residence

The primary dwelling in which a person lives, often eligible for certain tax benefits, like the deduction of mortgage interest and property taxes.

Gain Recognize

Gain Recognize refers to the process of reporting the profit earned from the sale of an asset for tax purposes.

Q4: The pricing strategy that results in greater

Q6: Describe various nontraditional organizational structures.

Q9: If the target profit is $60 000

Q42: When doing cost volume profit analysis, the

Q51: An organisation wanting to manage their environmental

Q66: The following is a list of the

Q66: Would you expect the following to be

Q67: C Limited manufactures specialist medical equipment. Recruitment

Q87: The marginal revenue curve:<br>A) shows the changes

Q95: Alclear Pool & Spa presently provides a