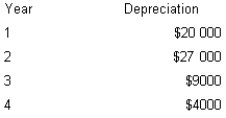

Abco Pty Ltd is considering the purchase of $60 000 in tools. The manager estimates that the tools will generate $25 000 in savings during each year of a four-year life. The tools will be depreciated based on the following schedule.

The expected tax rate is 30 per cent. What is the tax effect of the depreciation in year 3? (Ignore time value of money)

Definitions:

Delivering

The process of transporting an item from one location to another or the act of providing a given service or benefit.

Physical Staging

The arrangement and setup of physical space, especially for events, performances, or presentations, to enhance communication or experience.

Sequence of Presentation

The order in which content or information is arranged and presented to the audience.

Supporting Information

Additional details or data provided to back up or reinforce the main points or arguments in a discussion, presentation, or written document.

Q32: The split-off point is that stage in

Q39: Tots N Style Pty Ltd has the

Q52: The accounting rate of return is a

Q61: Decision problems involving accounting data are specified

Q69: When assessing three projects with profitability indexes

Q71: The contribution margin per unit is calculated

Q73: Which of the following activities are non-value-added

Q76: From the following, calculate the amount of

Q80: Generally, joint costs are not relevant in

Q101: If the contribution margin is $10, the