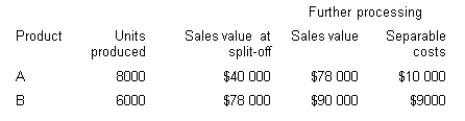

C Limited produces two products (A and B) from a particular joint process. Each product may be sold at split-off or may be further processed. Joint production costs for the year amounted to $60 000. Sales values and costs are as follows.

If the joint production costs were assigned using the net realisable value method, the joint costs allocated to B would be:

Definitions:

Saving

The process of setting aside a portion of current income for future use, either by depositing money in a bank or purchasing financial instruments.

Benefits-Received Principle

A theory of fairness holding that taxpayers should contribute to government (in the form of taxes) in proportion to the benefits they receive from public expenditures.

Public Goods

Items whose consumption is not depleted by an additional consumer and from which individuals cannot be excluded from using.

Tax Revenue

Revenue earned by governments through the application of taxes.

Q2: Compare and contrast traditional and nontraditional organizational

Q13: Organizational culture is NOT related to<br>A) the

Q15: Mod Clothiers makes women's clothes. It costs

Q46: Investment project E has equal annual cash

Q60: Abco Pty Ltd is considering the purchase

Q73: In a university, professors are designated as<br>A)

Q90: The manager of Malan Pty Ltd wants

Q97: Chelonia Ltd manufactures small robot toys. It

Q106: When management is unable to predict future

Q111: Which of the following statements regarding short-term