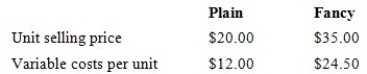

Maxie Pty Ltd makes and sells two types of shoes, Plain and Fancy. Product data is as follows:

Sixty per cent of the sales in units are Plain and annual fixed expenses are $45 000 and the sales mix remains constant. Assume an income tax rate of 20 per cent.

The break-even point for this data is 5000 units in total. How will the calculation of the break-even point change (if at all) if the relative percentages of the products in the mix change from 60 per cent Plain shoes to 40 per cent Fancy shoes?

Definitions:

Flatness Tolerance

A specification that defines the permissible amount of deviation from a perfectly flat surface.

Circularity

A geometric tolerancing term that describes the condition where all points on a circular feature are equidistant from a common center, ensuring roundness.

Ovality

A measurement of deviation from a perfect circle, often used to describe the condition or imperfection in cylindrical objects.

Q20: Quality and customer satisfaction are non-financial measures

Q34: Which of the following statements is/are false?<br>i.

Q35: Cartel Ltd has introduced a new product

Q38: What is the internal rate of return?<br>A)

Q39: Describe the six characteristics of the bureaucracy

Q46: A survey can have a positive effect

Q47: Which of the following represents the environmental

Q81: When making the decision of whether to

Q84: If the contribution margin is $10, the

Q109: The firm's fixed costs are $60 000,