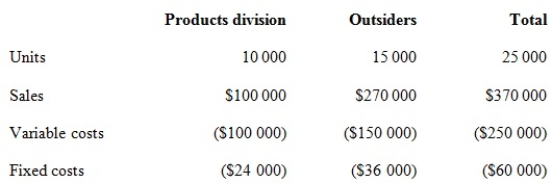

Corporate policy at Weber Pty Ltd requires that all transfers between divisions be recorded at variable cost as a transfer price. Divisional managers have complete autonomy in choosing their sources of customers and suppliers. The Milling Division sells a product called RK2. Forty per cent of the sales of RK2 are to the Products Division, while the remainder of the sales are to outside customers. The manager of the Milling Division is evaluating a special offer from an outside customer for 10 000 units of RK2 at a per unit price of $15.00. If the special offer were accepted, the Milling Division would be unable to supply those units to the Products Division. The Products Division could purchase those units from another supplier for $17 per unit. Annual capacity for the Milling Division is 25 000 units. The 2014 budget information for the Milling Division, based on full capacity, is presented below.

Assume that demand increases for the Milling Division. All 25 000 units can be sold at the regular price to outside customers and the Product Division's annual demand declines to 5000 units. What transfer price would be calculated under the general transfer-pricing formula?

Definitions:

Nightly TV News Reports

are daily television broadcasts that summarize major national and global news stories, often aired during prime viewing times in the evening.

Apostrophes

Punctuation marks used to indicate either possession or the omission of letters or numbers.

Individual Letters

Individual letters are single characters from an alphabet used in writing and communication.

AP Standard

Denotes the guidelines for news writing and journalism established by The Associated Press, including ethics, reporting practices, and language use.

Q3: The following dates apply to a specific

Q7: A company's plan for the acquisition of

Q7: Chelonia Ltd manufactures small robot toys. It

Q10: Consider a situation where an activity-based costing

Q17: Reports to stakeholders of a firm's performance

Q25: Hamilton Pty Ltd uses a standard costing

Q53: The position where the firm's goals and

Q55: Which of the following is used in

Q74: The income calculation for a divisional manager's

Q85: Which of the following statements regarding backflush