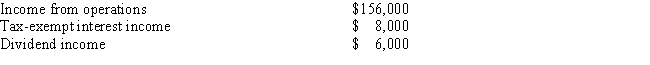

The partnership of Felix and Oscar had the following items of income during the tax year ended December 31, 2014: What is the total ordinary income from business activities passed through by the partnership for the 2014 tax year?

Definitions:

Nonmaleficence

A principle in ethics, especially medical ethics, that entails not causing harm to others.

APA Ethics Code

A set of guidelines and professional standards of conduct for psychologists, established by the American Psychological Association.

Beneficence

A principle in ethics focusing on actions that promote the well-being of others.

Nonmaleficence

A principle in medical ethics and other fields that entails not causing harm to others.

Q6: The election to expense is not permitted

Q13: Gordon is 60 years old and Mary

Q15: Employers must provide employees with their Form

Q16: All the following change as a function

Q24: Mark the correct answer. FICA taxes are:<br>A)7.65

Q30: Taxpayers are allowed two tax breaks for

Q30: In the case of long-term memory anterograde

Q45: What is the general theory of metamemory

Q64: What are two things that stay the

Q69: Jasmine is a single marketing manager with