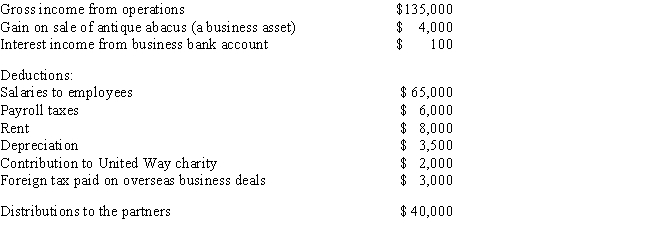

J. Bean and D. Counter formed a partnership. During the current year, the partnership had the following income and expenses:

a. Calculate the net ordinary income.

b. List all of the other items that need to be separately reported.

c. If the partnership is on a calendar year tax basis, when is the partnership tax return due?

Definitions:

Discrepancy Function

The difference between existing and desired conditions, used to identify gaps in performance or outcomes that need addressing.

Observational Learning

Learning that occurs through observing the behavior of others and the outcomes of those behaviors.

Imitating Others

The action of copying the behaviors, actions, or traits of others, often as a method of learning or fitting into a group.

Reinforcing Others

The act of encouraging and supporting behaviors in others that contribute positively to desired outcomes or goals.

Q10: A tax return with a large casualty

Q18: What is the recency effect of a

Q19: Charlie is a single taxpayer with income

Q25: An equal partnership is formed by Rita

Q50: Jerry bought his home 15 years ago

Q54: Amnesia refers to _.<br>A) the complete loss

Q57: Is it possible for a person to

Q62: Assuming a taxpayer has no other gains

Q66: Individual taxpayers may carry forward indefinitely charitable

Q69: After 4 years of life in the