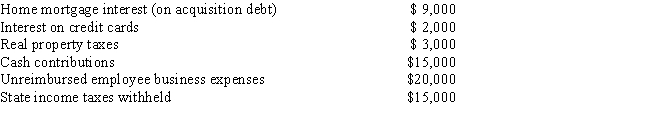

Dan and Maureen file a joint income tax return for 2014. They have two dependent children, ages 7 and 9. Together they earn wages of $152,000. They also receive taxable interest income of $8,000 and interest on City of Los Angeles bonds of $12,000. During 2014, they received a state income tax refund of $3,000 relating to their 2013 state income tax return on which they itemized deductions. Their expenses for the year consist of the following:

Calculate Dan and Maureen's tentative minimum tax liability assuming an exemption amount of $82,100, before any phase-outs. Show your calculations.

Definitions:

Ba'ath Party

A political party advocating Arab unity and socialism, historically significant in Syria and Iraq.

Plurality of Americans

A group within the United States population that represents the largest segment, but not necessarily an absolute majority.

U.S. Forces

Military personnel and units of the United States, including the Army, Navy, Air Force, Marines, and Coast Guard.

Iraq

A country in Western Asia, rich in history and culture, known for its ancient civilizations such as Sumer and Babylon, and more recent conflicts.

Q16: Barry is a self-employed attorney who travels

Q18: Which of the following is not an

Q32: Peter and Joan are married and Joan

Q35: Marco makes the following business gifts during

Q38: Clark, a widower, maintains a household for

Q46: The Peach Corporation is a regular corporation

Q56: A theft loss is deductible in the

Q68: If an employer makes a contribution to

Q87: Assume Alan's parents make gifts of $10,000

Q100: If your spouse dies during the tax