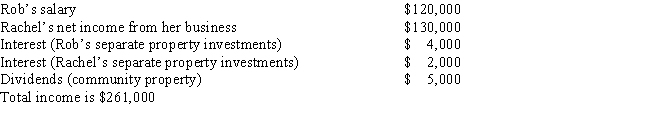

Rachel and Rob are married and living together in California. Their income is:

a. If Rachel files a separate return, how much income should she report?

b. If Rob and Rachel live in Texas, what should Rachel report as income?

Definitions:

Adequate Amounts

Sufficient quantities or levels of something, such as nutrients or resources, necessary to meet the needs or requirements of a situation or condition.

Pale And Cool

Describes a physical state where the skin appears lighter than normal and feels cold to the touch, often indicating poor circulation or shock.

Discharge Planning

A process used by healthcare professionals to prepare a patient to leave the hospital or medical facility, ensuring continuity of care and adequate support.

Pneumonia

An inflammatory condition of the lung affecting primarily the small air sacs known as alveoli, typically caused by infectious agents like bacteria, viruses, and fungi.

Q21: Bob is a machinist in a remote

Q43: a. Norm and Linda are married, file

Q58: Dividend income is not subject to the

Q59: In 2014, Alex has income from wages

Q59: Mary Lou took an $8,000 distribution from

Q78: Walt and Jackie rent out their residence

Q86: Phillip and Naydeen Rivers are married with

Q92: Lorreta has a manufacturing business. In 2014,

Q98: Sally and Martha are tax accountant partners

Q108: Which of the following taxes is not