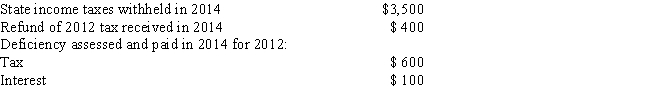

Frank is a resident of a state that imposes a tax on income. The following information pertaining to Frank's state income taxes is available: What amount should Frank use as state and local income taxes in calculating itemized deductions for his 2014 Federal tax return, assuming he elects to deduct state and local income taxes?

Definitions:

Minimum Standard

A predefined level of quality, performance, or capability that products, services, or processes must meet or exceed, often set by regulatory bodies.

Marginal Tax Rate

The marginal tax rate is the percentage of tax applied to your income for each tax bracket in which you qualify, essentially the tax rate on your last dollar of income.

Progressive Tax

A tax system in which the tax rate increases as the taxable amount increases, often aimed at ensuring tax equity.

Sales Taxes

Taxes imposed by governments on the sale of goods and services, collected by sellers at the point of sale.

Q19: If a Section 401(k) plan allows an

Q21: The interest paid on a loan used

Q21: Bob is a machinist in a remote

Q25: If an employer claims a business deduction

Q26: Lilac Designs is a partnership with a

Q27: Elwin worked at three jobs during 2014.

Q48: A partnership tax year will close if

Q58: In 2014, Helen sold Section 1245 property

Q64: A parent may elect to include a

Q78: Mark the correct answer. Self-employment taxes:<br>A)Consist of