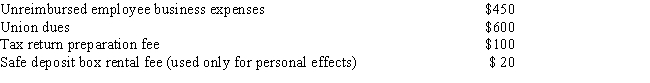

Peter is a plumber employed by a major contracting firm. During 2014, he paid the following miscellaneous expenses: If Peter were to itemize his deductions for 2014, what amount could he claim as miscellaneous itemized deductions (before applying the 2 percent of adjusted gross income limitation) ?

Definitions:

Short-sighted

lacking foresight or perspective; making decisions based on immediate rather than long-term outcomes.

Synergy

The interaction or cooperation of two or more organizations, substances, or other agents to produce a combined effect greater than the sum of their separate effects.

Organizational

Pertaining to the structure and functioning of an organization, including its systems, processes, and dynamics.

Management

The process of planning, organizing, leading, and controlling resources to achieve organizational goals efficiently and effectively.

Q26: Mortgage interest on a taxpayer's personal residence

Q29: The Foemina Corporation has two employees, Nancy

Q34: The cost of a chiropractor's services qualifies

Q37: Gary is a self-employed accountant who pays

Q40: A scholarship for room and board granted

Q52: If a taxpayer's adjusted gross income exceeds

Q81: Unearned income of a 16-year-old child may

Q89: During 2014, Travis purchases $13,000 of used

Q90: What is the amount of the deductible

Q102: Which of the following may be excluded