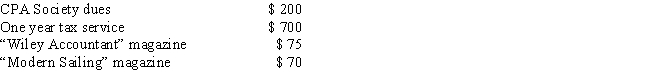

Catherine is a CPA employed by a large accounting firm in San Francisco. In 2014, she paid the following amounts: How much may she deduct on Schedule A as a miscellaneous deduction, before considering the 2 percent of adjusted gross income limitation?

Definitions:

Majority And Minority

Terms related to the larger part of a group (majority) and the smaller part or subgroups within it (minority), often discussed in the context of social dynamics and power structures.

Social Impact

The influence or effect of an individual or group on others, often measured by changes in behaviors, attitudes, or social structures.

Latané

Refers to Bibb Latané, a social psychologist known for his work on social impact theory and the bystander effect.

Consolidation

The process of combining assets, liabilities, and other financial items of two or more entities into one.

Q10: For 2014, personal and dependency exemptions are

Q16: If an individual taxpayer discovers that his

Q18: Ellen loans Nicole $45,000 to start a

Q23: The taxpayer generally has only 1 year

Q36: If a taxpayer takes a trip within

Q39: Which of the following types of interest

Q61: If an employee is transferred to a

Q67: If an employee receives a reimbursement for

Q107: In determining whether an activity should be

Q113: Kenzie is a research scientist in Tallahassee,