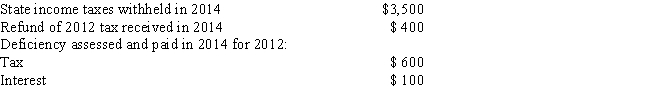

Frank is a resident of a state that imposes a tax on income. The following information pertaining to Frank's state income taxes is available: What amount should Frank use as state and local income taxes in calculating itemized deductions for his 2014 Federal tax return, assuming he elects to deduct state and local income taxes?

Definitions:

Adult

An individual who has reached maturity or the legal age of majority, which varies by jurisdiction but is typically recognized as 18 years or older.

Infant's Heart Rate

The number of heartbeats per minute in an infant, an important vital sign in assessing the cardiovascular health and overall well-being of a baby.

Apical

Pertaining to the apex or highest point, often used in medical contexts to describe the location of the apex of the heart or a lung.

Q10: Tom is employed by a large consulting

Q27: In 2014, what rate would a taxpayer

Q36: Which one of the following is not

Q37: In 2014, all taxpayers may make a

Q42: If an annuitant, whose annuity starting date

Q44: The IRS:<br>A)requires official tax forms be obtained

Q44: Group term life insurance premiums paid by

Q53: If insurance proceeds exceed the taxpayer's basis

Q70: Gene is a self-employed taxpayer working from

Q71: Mark the correct statement.<br>A)Residential real property is