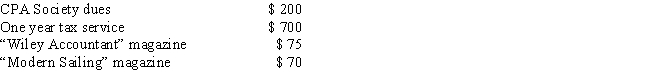

Catherine is a CPA employed by a large accounting firm in San Francisco. In 2014, she paid the following amounts: How much may she deduct on Schedule A as a miscellaneous deduction, before considering the 2 percent of adjusted gross income limitation?

Definitions:

Direct Labor Cost

The total cost of employment for employees who directly contribute to the production of goods or services, including wages and benefits.

Machine-Hours

A measure of the total time that machines are operating in a manufacturing process.

Predetermined Overhead Rate

The predetermined overhead rate is calculated by dividing estimated overhead costs by an allocation base, such as direct labor hours, to allocate overhead costs to products or services.

Manufacturing Overhead

All indirect costs related to the production process, such as the costs of maintenance, supplies, and utilities, excluding direct materials and direct labor.

Q24: On January 1, 2014, Ted purchased a

Q29: Mary sells to her father, Robert, her

Q48: A gift received from a financial institution

Q76: Dividend income arising from stock received as

Q77: An item is not included in gross

Q79: Marco and his family are covered by

Q102: Brian is 60 years old, single and

Q108: Which of the following taxes is not

Q110: A "no-additional-cost" service includes only those services

Q123: Dr. J's outstanding player award is not