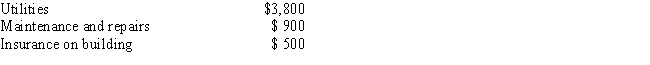

Bill is the owner of a house with two identical apartments. He resides in one apartment and rents the other apartment to a tenant. The tenant made timely monthly rental payments of $550 per month for the months of January through December, 2014. The following expenses were incurred on the entire building: In addition, depreciation allocable to the rented apartment is $1,500. What amount should Bill report as net rental income for 2014?

Definitions:

IT Architecture

A framework for specifying the structure and operation of an organization’s IT resources, including hardware, software, data, and networking components, to achieve business goals efficiently.

Organization Strategic Plan

An Organization Strategic Plan outlines an organization's long-term goals and the strategies to achieve them, often including missions, visions, and action plans.

IS Operational Plan

Information Systems Operational Plan, a detailed plan that outlines how information systems will support the operational aspects of a business or organization.

IT Strategic Plan

A set of long-range goals that describe the IT infrastructure and major IT initiatives needed to achieve the goals of the organization.

Q13: Patrick owns a home on the beach

Q36: In 2014, Lew earned wages of $386,724.<br>a.

Q39: As a Christmas thank you for being

Q40: Marty earned $5,000 in interest income from

Q48: Curly and Rita are married, file a

Q62: If an automobile is purchased for 100

Q74: For 2014, the investment interest expense deduction

Q89: Harvey itemized deductions on his 2013 income

Q94: Bobby is an accountant who uses a

Q124: Married taxpayers may double their standard deduction