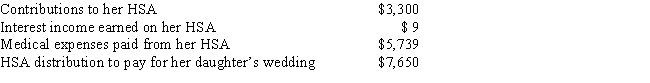

Miki, who is single and 57 years old, has a quaifying high-deductible insurance plan. She had the following transactions with her HSA during the year:

a. How much may Miki claim as a deduction for adjusted gross income?

b. What is the amount that Miki must report on her tax return as income from her HSA?

c. How much is subject to a penalty? What is the penalty percentage?

Definitions:

Amoebozoans

A group of amoeba-like eukaryotes, characterized by their amorphous shape and movement through cytoplasmic streaming.

Flagella

Long, whip-like appendages that protrude from the cell body of certain prokaryotic and eukaryotic cells, used for locomotion or sensory functions.

Serial Endosymbiosis

The hypothesis that certain organelles such as mitochondria and chloroplasts originated as symbiotic prokaryotes that lived inside other free-living prokaryotic cells.

Mitochondria

Organelles found in the cytoplasm of most eukaryotic cells, responsible for producing energy through the process of oxidative phosphorylation.

Q22: An auto that is received as a

Q23: Which of the common deductions below are

Q45: Mark the correct answer. Section 197 intangibles:<br>A)Are

Q49: Salary earned by minors may be taxed

Q54: If a capital asset acquired on October

Q58: The expense of a review course for

Q78: A company that competes by offering unique

Q80: Under the terms of a property settlement

Q81: Gerald is single and earns $80,000 in

Q114: Katie operates a ceramics studio from her