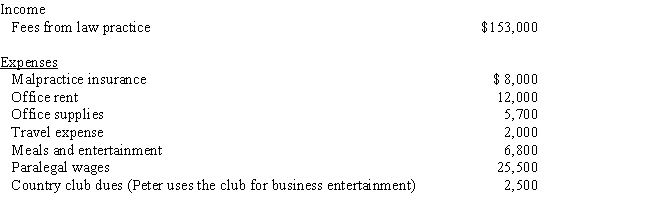

Peter is a self-employed attorney. He gives the following information about his business to his CPA for use in preparing his 2014 tax return:

Peter also drove his car 5,191 miles for business and used the standard mileage method for computing transportation costs. How much will Peter show on his Schedule C for 2014 for:

a.Income

b.Tax deductible expenses

c.Taxable income

Definitions:

Credit Decreases

In accounting, actions that decrease liabilities or increase assets, typically reflected in the credits column of a ledger.

Account

A record that summarizes financial transactions of a specific type, such as revenue, expenses, assets, or liabilities.

Credit

An accounting entry that increases a liability or equity account, or decreases an asset or expense account.

Increased

A term indicating that a numerical value, quantity, or financial metric has gone up from a previous measurement.

Q8: Several research studies have conclusively proven that

Q24: Eugene and Velma are married. For 2014,

Q24: On January 1, 2014, Ted purchased a

Q39: On June 2, 2014, Scott purchased a

Q46: Which one of the following factors has

Q48: A gift received from a financial institution

Q51: Vinnie has a small retail store and

Q61: Roger, age 39, and Lucy, age 37,

Q81: Steve Corp bought a $600,000 apartment building

Q110: List each alternative filing status available to