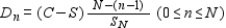

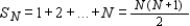

One of the methods that the Internal Revenue Service allows for computing depreciation of certain business property is the sum-of-the-years'-digits method. If a property valued at C dollars has an estimated useful life of N years and a salvage value of S dollars, then the amount of depreciation Dn allowed during the nth year is given by  where SN is the sum of the first N positive integers representing the estimated useful life of the property. Thus,

where SN is the sum of the first N positive integers representing the estimated useful life of the property. Thus,  If office furniture worth $7,300 is to be depreciated by this method over N = 11 years and the salvage value of the furniture is $700, find the depreciation for the third year by computing D3 .

If office furniture worth $7,300 is to be depreciated by this method over N = 11 years and the salvage value of the furniture is $700, find the depreciation for the third year by computing D3 .

Definitions:

Alternator

An electrical generator that converts mechanical energy to electrical energy in the form of alternating current.

Converter

A device that changes the form of an electrical signal or power source, such as converting alternating current (AC) to direct current (DC).

Paul Revere's Engraving

A famous engraving by Paul Revere that depicted the 1770 Boston Massacre, which played a significant role in galvanizing public sentiment against British rule in the American colonies.

Boston Massacre

An event in 1770 in which British soldiers killed five civilian men in Boston, fueling anger that contributed to the American Revolutionary War.

Q5: Determine whether the statement is true or

Q58: Find the smallest possible set (that is,

Q69: Find the accumulated amount A if the

Q72: Five and a half years ago, Chris

Q87: Find the book value of office equipment

Q91: A farmer plans to plant two crops,

Q94: Solve the linear programming problem by the

Q105: Find the book value of office equipment

Q114: Solve the given minimization problem by the

Q162: How many four-letter code words can be