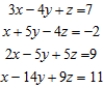

Solve the system of linear equations, using the Gauss-Jordan elimination method.

Definitions:

Tax-Exempt Municipal

Refers to income earned from municipal bonds that is exempt from federal income tax and, in many cases, state and local taxes.

Pretax Financial Income

The amount of income a company has earned before any taxes have been deducted, often used for internal reporting.

Taxable Income

The amount of an individual's or entity's income used to determine how much tax is owed, calculated by deducting allowable deductions from gross income.

Permanent Difference

A discrepancy between taxable income and accounting income that will not reverse over time, affecting the tax and financial reporting separately.

Q96: Use the simplex method for solving nonstandard

Q99: Determine whether the equation defines y as

Q102: Solve the linear programming problem by the

Q105: The annual interest on Sid Carrington's three

Q112: Write a system of linear inequalities that

Q128: Solve the linear system of equations. If

Q152: The quantity demanded each month of Russo

Q192: A simple economy consists of two industries:

Q226: Compute the product.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6027/.jpg" alt="Compute the

Q239: Let <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6027/.jpg" alt="Let