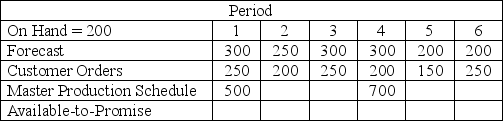

Given the information below, the number of available-to-promise units in period 1 is

Definitions:

Positive Charge

A type of electric charge carried by protons and indicative of a deficiency of electrons.

Proton

A subatomic particle found in the nucleus of an atom, carrying a positive electrical charge.

Atom

The smallest part of an element that contains all the properties of that element.

Current Flows

Current flows refer to the movement of electric charge carriers, such as electrons, through a conductor or circuit, driven by a voltage difference.

Q5: At a Wal-Mart store, simulation can be

Q7: For a less than or equal to

Q16: Atlas Inc. produces product A and product

Q24: The following information relates to a company's

Q28: Information sharing in support of supply chain

Q56: The traditional approach to inventory management is

Q56: How would you use <sup>1</sup>H NMR spectroscopy

Q62: Analyzing process flow and eliminating waste is

Q79: Regression is used for forecasting when there

Q90: A forecast<br>A) predicts what will occur in