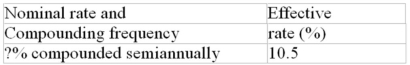

Calculate the missing interest rate (to the nearest 0.01%)

Definitions:

Dependent Variable

In an experiment, the variable that is being tested and measured, which is expected to change as a result of manipulations to the independent variable.

Operational Definition

A description of a concept solely in terms of the specific process or set of validation tests used to determine its presence and quantity.

Decibel Level

A unit of measurement for the intensity of sound, defined as ten times the logarithm to base 10 of the ratio of two power levels.

Anger

A strong emotion characterized by feelings of hostility, frustration, or antagonism towards someone or something perceived to have caused harm.

Q29: Calculate nominal rate of interest (to the

Q132: If the current discount rate on 15-year

Q154: What was the annually compounded nominal rate

Q169: Wojtek purchased a $10,000 face value strip

Q174: A stock valued at $75 decreased by

Q245: Calculate the missing interest rate (to the

Q254: A portfolio earned annual rates of 18%,

Q282: A $100,000 face value Treasury bill with

Q309: A stock valued at $150 increased by

Q346: The Consumer Price Index rose from 131.2