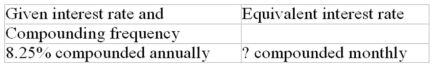

Calculate the equivalent interest rate (to the nearest 0.01%)

Definitions:

Ability-To-Pay Principle

The ability-to-pay principle is a tax theory suggesting that taxes should be levied based on the taxpayer’s capacity to pay, implying that wealthier individuals should pay more in taxes.

Gasoline Tax

A tax imposed on the sale of gasoline, often used by governments to raise revenue and discourage excessive fuel consumption.

Mortgage-Interest Deduction

A tax deduction for mortgage interest paid on the first $750,000 of mortgage debt, available to U.S. taxpayers.

Horizontal Equity

The principle that individuals with similar financial situations should be treated equally by the taxation system.

Q5: The use of Body Mass Index charts

Q11: Special situations that may require the use

Q17: Child death from maltreatment is most often

Q30: Health policies are needed for all of

Q30: Medical home providers include all of the

Q55: Superlotto offers a choice of $1,000 per

Q102: Judy invested $8,500 in a three-year compound-interest

Q224: In your search for the best rate

Q287: What is the semi-annually compounded nominal rate

Q310: The following table presents the rates of