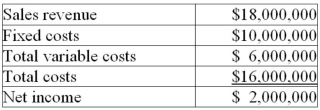

Beta Inc. has based its budget forecast for next year on the assumption it will operate at 90% of capacity. The budget is  a) At what percentage of capacity would Beta break even?

a) At what percentage of capacity would Beta break even?

b) What would be Beta's net income if it operates at 70% of capacity?

Definitions:

Interest Rates

The cost of borrowing money or the rate paid for the privilege of using someone else's money, usually expressed as a percentage.

Inverted Yield Curve

An inverted yield curve occurs when long-term debt instruments have a lower yield than short-term debt instruments, often considered a forewarning of economic recession.

Convertible Bonds

Bonds issued by a corporation that can be converted into a predetermined number of the company's shares at certain times during the bond's life, usually at the discretion of the bondholder.

Bond Yields

The return an investor realizes on a bond, calculated as the annual interest payment divided by the bond's current market price.

Q21: M Studios retails their own brand of

Q49: A manufacturing company is studying the feasibility

Q67: An invoice for $25,000 dated March 15

Q107: The distributor of Nikita power tools is

Q136: Which of the following two payment streams

Q138: On May 1, Gladis borrowed $10,000 on

Q155: An $8,000 demand loan at a fixed

Q164: An assignable loan contract executed three months

Q275: If you pay your $3,000 tuition 3

Q287: If money if worth $650 now and