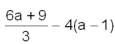

Simplify:

Definitions:

Deductibility

Refers to the extent to which an expense can be subtracted from gross income to reduce taxable income.

Self-Employed Individuals

People who work for themselves, not as employees of another, and are responsible for their own taxes and benefits.

Deduction Limitations

Restrictions placed on the amount that can be deducted from taxable income, often varying by the type of deduction and the taxpayer's income level.

Alimony Deduction

A tax deduction previously allowed for payments made under a divorce or separation agreement to a spouse or ex-spouse, phased out after the 2018 tax year for new agreements.

Q20: A three-year magazine subscription costing $120 is

Q41: Statistics Canada calculates separate subindexes of the

Q70: Perform the operation indicated and collect like

Q74: A plumber charges a flat $100 for

Q97: Simplify: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4281/.jpg" alt="Simplify: " class="answers-bank-image

Q144: The calculated monthly payment on a loan

Q156: Evaluate to six-figure accuracy: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4281/.jpg" alt="Evaluate

Q164: The late 1970s and early 1980s were

Q228: General Paint and Cloverdale Paint normally offer

Q294: Sam, Domenic, and Sal invested $100,000, $150,000